€15.6 billion of investment providing the country the European champion capable of building the gas industry of the future. These include the acquisition of 2i Rete Gas and the widespread application of AI – across gas, water, energy efficiency and information technology – which is expected to drive double-digit net income growth throughout the Plan period. The floor of the dividend policy to 2026 has also been improved.

Milan, October 7, 2024 – The CEO of Italgas, Paolo Gallo, today presents the Group’s Strategic Plan for the period 2024-2030 to analysts and investors, approved by the Company’s Board of Directors chaired by Benedetta Navarra.

€15.6 billion are the expected investments over the plan period, with an increase of €7.5 billion (+92% compared to the previous plan) and aimed at the acquisition of 2i Rete Gas, interventions for the development of gas distribution in Italy and Greece, strengthening the presence in the water sector, and accelerating the growth in energy efficiency, with a strong commitment to achieving EU climate targets.

Italgas emphasizes its commitment to consolidating the gas distribution sector in Italy with the aim of multiplying synergies to ensure significant benefits for families and businesses in terms of safety, efficiency, service quality, decarbonization of end uses, and costs. The use of artificial intelligence across all Group activities will also enable a new phase of digital transformation, accelerating the ecological transition.

The Group will continue to benefit from a solid and efficient financial structure, with a commitment to maintaining the current credit rating. The expected synergies and operational efficiencies allow for a forecast of double-digit net income growth over the plan period1. Therefore, it has been possible to raise the floor of the dividend policy until 2026, ensuring a growth rate of 5% annually starting from the dividend 2023 of €0.352 per share2, while also confirming the 65% payout.

Highlights

* Italgas is the European leader in gas distribution, with unique capabilities of innovation, digitalization and investment.

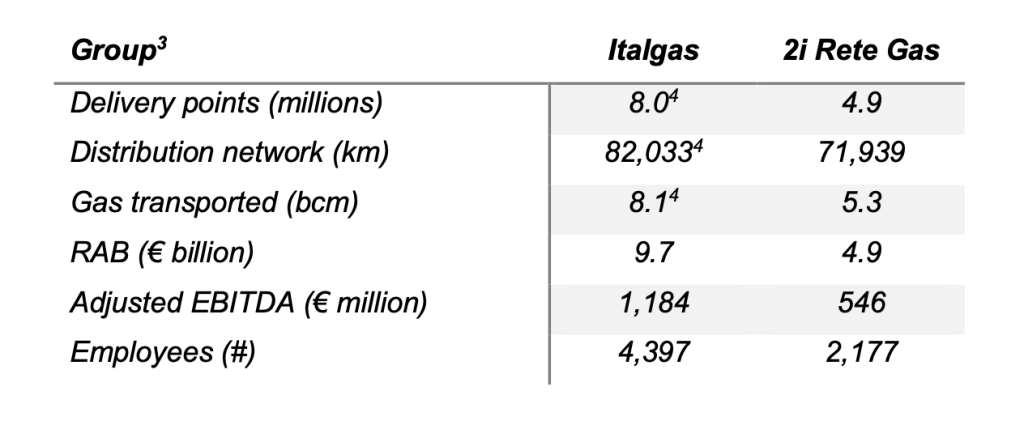

* Acquisition of 2i Rete Gas for €5.3 billion of enterprise value, with a 4% premium on the 2025 expected RAB and closing expected within the 1H 2025.

* Financing of the transaction through debt and a €1 billion capital increase, aimed at preserving the credit rating.

* €15.6 billion of total investments for the acquisition of 2i Rete Gas, and for the development, digitalization, and repurposing of infrastructures in Italy and Greece.

* €200 million in synergies from efficiencies, cost reductions, and AI, in addition to €80 million revenues from incremental investments in digitization on 2i Rete Gas network by 2030.

* EPS accretion starting from 2026, including the expected capital increase, reaching approximately 15% in 2029.

* Double-digit net income growth anticipated by 2030.

* Dividend policy: confirmed the 65% payout and increased floor to 5% annual growth, now based on the 2023 DPS.

* Confirmation of ESG targets also including the new perimeter and Net Zero goal by 2050.

* Strong focus on people and the integration of resources from 2i Rete Gas, emphasizing training and promoting diversity, equal opportunities, and inclusion.

Italgas CEO Paolo Gallo stated:

“The Strategic Plan 2024-2030 will go down in Italgas’ history as the blueprint for creating the European champion in gas distribution, further reinforcing our commitment to the digital transformation of infrastructure, benefiting the entire country. The new scale of the Group, combined with innovation and digital transformation, is the decisive factor in ensuring we meet the targets of the energy transition, the security of supply and the sustainability of energy costs for individuals and businesses. An investment of €15.6 billion will provide a strong boost to our growth trajectory, with the largest share once again allocated to the development, digitization, and repurposing of the gas distribution network in both Italy and Greece. Our commitment to the widespread use of Artificial Intelligence will enable us to enter a new phase of digital transformation. Digital transformation remains the primary strategic lever also for strengthening our activities in the water sector and energy efficiency. With €750 million, we will continue to work towards enhancing our role as a key player in water — which has long suffered from a lack of adequate smart investments in networks — and to grow in energy efficiency as an essential tool for achieving energy transition goals.The figures in this Plan, with an average annual growth of 13% in EBITDA and net profit by 2030, demonstrate how the extraordinary capabilities of the women and men of Italgas and 2i Rete Gas can create value for shareholders and all stakeholders, leveraging efficiency, innovation, and sustainability.”

Creation of the European champion with the acquisition of 2i Rete Gas.

The integration of 2i Rete Gas creates the European champion in the gas distribution sector, with unique investment and innovation capabilities, based on a clear strategic rationale:

1. The European Champion: The consolidation of the gas distribution sector in Italy allows for the acceleration of investments and uniform development of the national infrastructure.

2. Platform to Foster Investments and Energy Transition: The increased investment capacity will enable the company to continue playing a leading role in supporting a safe, sustainable, and cost-effective ecological transition.

3. Value Creation: Growth and investment opportunities in innovation, the development of industrial synergies, and cost efficiencies will maximize value creation for shareholders and all stakeholders. The new corporate structure will benefit from Italgas’ know-how in asset digitization and its track record of operational excellence from the listing to the present days.

With over 6,500 employees, the new entity will serve 12.9 million customers on gas infrastructure in Italy and Greece, distributing an average of over 13 billion cubic meters of gas each year through 154,000 kilometers of networks.

The consideration (equity value) of the transaction is 2.060 billion euros. The net financial debt and other net liabilities as of December 31, 2023, amount to 3.246 billion euros. The closing of the transaction is expected within the first half of 2025, subject to obtaining the necessary regulatory approvals.

The transaction is expected to have a positive impact on earnings per share as early as the first year following the closing, considering the planned rights issue amounting to 1 billion euros, fully secured through a stand-by underwriting agreement.

€15.6 billion of investment providing the country the European champion capable of building the gas industry of the future. These include the acquisition of 2i Rete Gas and the widespread application of AI – across gas, water, energy efficiency and information technology – which is expected to drive double-digit net income growth throughout the Plan period. The floor of the dividend policy to 2026 has also been improved.

Milan, October 7, 2024 – The CEO of Italgas, Paolo Gallo, today presents the Group’s Strategic Plan for the period 2024-2030 to analysts and investors, approved by the Company’s Board of Directors chaired by Benedetta Navarra.

€15.6 billion are the expected investments over the plan period, with an increase of €7.5 billion (+92% compared to the previous plan) and aimed at the acquisition of 2i Rete Gas, interventions for the development of gas distribution in Italy and Greece, strengthening the presence in the water sector, and accelerating the growth in energy efficiency, with a strong commitment to achieving EU climate targets.

Italgas emphasizes its commitment to consolidating the gas distribution sector in Italy with the aim of multiplying synergies to ensure significant benefits for families and businesses in terms of safety, efficiency, service quality, decarbonization of end uses, and costs. The use of artificial intelligence across all Group activities will also enable a new phase of digital transformation, accelerating the ecological transition.

The Group will continue to benefit from a solid and efficient financial structure, with a commitment to maintaining the current credit rating. The expected synergies and operational efficiencies allow for a forecast of double-digit net income growth over the plan period1. Therefore, it has been possible to raise the floor of the dividend policy until 2026, ensuring a growth rate of 5% annually starting from the dividend 2023 of €0.352 per share2, while also confirming the 65% payout.

Highlights

* Italgas is the European leader in gas distribution, with unique capabilities of innovation, digitalization and investment.

* Acquisition of 2i Rete Gas for €5.3 billion of enterprise value, with a 4% premium on the 2025 expected RAB and closing expected within the 1H 2025.

* Financing of the transaction through debt and a €1 billion capital increase, aimed at preserving the credit rating.

* €15.6 billion of total investments for the acquisition of 2i Rete Gas, and for the development, digitalization, and repurposing of infrastructures in Italy and Greece.

* €200 million in synergies from efficiencies, cost reductions, and AI, in addition to €80 million revenues from incremental investments in digitization on 2i Rete Gas network by 2030.

* EPS accretion starting from 2026, including the expected capital increase, reaching approximately 15% in 2029.

* Double-digit net income growth anticipated by 2030.

* Dividend policy: confirmed the 65% payout and increased floor to 5% annual growth, now based on the 2023 DPS.

* Confirmation of ESG targets also including the new perimeter and Net Zero goal by 2050.

* Strong focus on people and the integration of resources from 2i Rete Gas, emphasizing training and promoting diversity, equal opportunities, and inclusion.

Italgas CEO Paolo Gallo stated:

“The Strategic Plan 2024-2030 will go down in Italgas’ history as the blueprint for creating the European champion in gas distribution, further reinforcing our commitment to the digital transformation of infrastructure, benefiting the entire country. The new scale of the Group, combined with innovation and digital transformation, is the decisive factor in ensuring we meet the targets of the energy transition, the security of supply and the sustainability of energy costs for individuals and businesses. An investment of €15.6 billion will provide a strong boost to our growth trajectory, with the largest share once again allocated to the development, digitization, and repurposing of the gas distribution network in both Italy and Greece. Our commitment to the widespread use of Artificial Intelligence will enable us to enter a new phase of digital transformation. Digital transformation remains the primary strategic lever also for strengthening our activities in the water sector and energy efficiency. With €750 million, we will continue to work towards enhancing our role as a key player in water — which has long suffered from a lack of adequate smart investments in networks — and to grow in energy efficiency as an essential tool for achieving energy transition goals.The figures in this Plan, with an average annual growth of 13% in EBITDA and net profit by 2030, demonstrate how the extraordinary capabilities of the women and men of Italgas and 2i Rete Gas can create value for shareholders and all stakeholders, leveraging efficiency, innovation, and sustainability.”

Creation of the European champion with the acquisition of 2i Rete Gas.

The integration of 2i Rete Gas creates the European champion in the gas distribution sector, with unique investment and innovation capabilities, based on a clear strategic rationale:

1. The European Champion: The consolidation of the gas distribution sector in Italy allows for the acceleration of investments and uniform development of the national infrastructure.

2. Platform to Foster Investments and Energy Transition: The increased investment capacity will enable the company to continue playing a leading role in supporting a safe, sustainable, and cost-effective ecological transition.

3. Value Creation: Growth and investment opportunities in innovation, the development of industrial synergies, and cost efficiencies will maximize value creation for shareholders and all stakeholders. The new corporate structure will benefit from Italgas’ know-how in asset digitization and its track record of operational excellence from the listing to the present days.

With over 6,500 employees, the new entity will serve 12.9 million customers on gas infrastructure in Italy and Greece, distributing an average of over 13 billion cubic meters of gas each year through 154,000 kilometers of networks.

The consideration (equity value) of the transaction is 2.060 billion euros. The net financial debt and other net liabilities as of December 31, 2023, amount to 3.246 billion euros. The closing of the transaction is expected within the first half of 2025, subject to obtaining the necessary regulatory approvals.

The transaction is expected to have a positive impact on earnings per share as early as the first year following the closing, considering the planned rights issue amounting to 1 billion euros, fully secured through a stand-by underwriting agreement.